On-Premise Software

Our asset tracking software's functionality is truly unrestricted:

An exclusive relational design time tested to deliver near perfect efficiency and data accuracy.

Two different mobile data collection solutions.

Inventory types for grouped and individual assets.

Complete audit trails with clear change history tracking.

Data Import feature to create seamlessly your original database and continued asset additions

Ability to adapt cleanly to your environment using user defined data, field aliases, multiple data types, custom views and more.

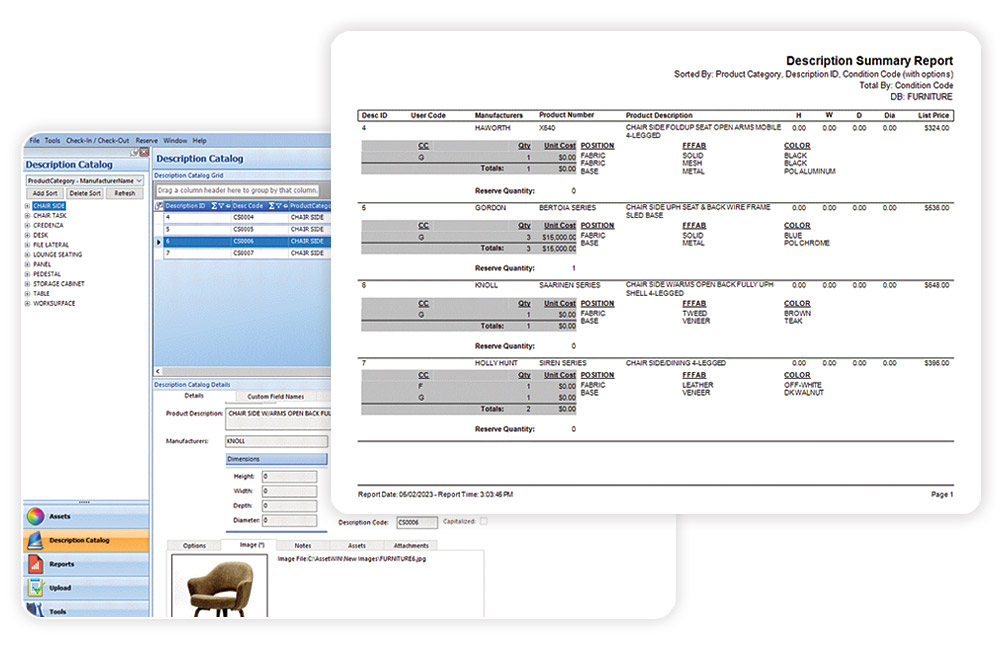

Over 200 standard reports you can design and a report writer for quick views on demand

Asset Check-in/Check-out with past due reminders

Fully integrated Depreciation module with functional security and automatic entry of capital assets.

Version of AssetWIN Tracking Software

AssetWIN Enterprise

Enterprise-grade asset management software designed for the most demanding environments, AssetWIN Enterprise combines a unique application feature set with the latest technology to achieve an unparalleled solution to manage assets for their complete life cycle.

No limit on number of assets.

SQL Server back-end database.

AssetWIN Business Series

Designed for the mid-range asset manager who needs a functionally strong system that can manage a variety of asset types and users in one system. It provides controls, both user-defined and architecturally designed, that assure your data is accurate and reliable.

No limit on number of assets.

Access back-end database.